Policymakers at the Bank of England are expected to cut interest rates – bringing the Bank rate down to its lowest level since February 2023.

Analysts are widely predicting a fall from 4% to 3.75%, although they do not expect a unanimous decision among the nine-member Monetary Policy Committee (MPC).

This would be the sixth cut in interest rates from August last year.

The Bank rate heavily influences the cost of borrowing by consumers, but also the returns given to savers.

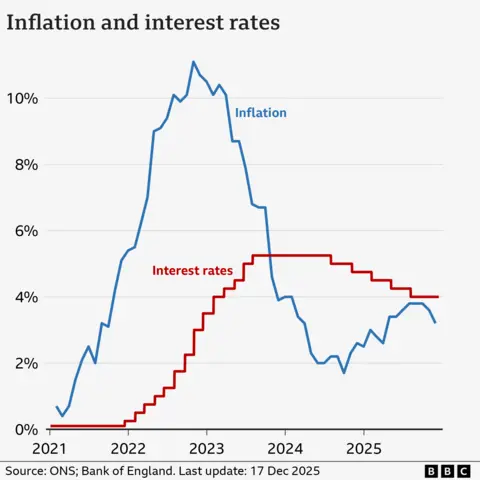

The MPC has a target to keep inflation – which charts the rising cost of living – to 2%. The Bank rate is the committee’s primary tool for achieving its ambition.

The latest inflation data, published on Wednesday, showed a bigger drop to Consumer Prices Index (CPI) inflation than analysts had been expecting.

The rate of CPI fell to 3.2% in November, from 3.6% in October, the Office for National Statistics (ONS) said.

While inflation remains above the Bank’s target, the latest fall in the rate and signs of rising unemployment and a relatively stagnant economy are likely to push the committee towards an interest rate cut.

At the previous meeting in November, the four members of the MPC who voted for a cut were only just outvoted by the five who wanted to keep rates on hold.

At the time, the Bank’s governor, Andrew Bailey, said he would “prefer to wait and see” whether inflation continued to drop back.

James Smith, developed market economist for ING, said the sharp drop in the November rate of inflation “green lights” a rate cut.

He said the “latest drop in inflation fits into a broader body of evidence suggesting that price pressures are cooling”.

He is forecasting another two cuts to interest rates in February and April next year, although not all analysts agree with this suggestion.

Impact on borrowing and savings

About 500,000 homeowners have a mortgage that “tracks” the Bank of England’s rate. If a 0.25 percentage point cut does come, it is likely to mean a typical reduction of £29 in their monthly repayments.

For the additional 500,000 homeowners on standard variable rates, there would typically be a £14 a month fall, assuming there is a cut in the Bank rate and lenders pass on the cut to their customers.

The vast majority of mortgage customers have fixed-rate deals. Rates on these deals have been falling recently, owing to the expectation among lenders of a Bank rate cut in December.

As of 17 December, the average two-year fixed residential mortgage rate was 4.82%, according to financial information company Moneyfacts. A five-year rate was 4.90%.

Mortgage rate cuts should also reduce some financial pressure on landlords, and perhaps ease the likelihood of rent rises for tenants.

However, savers are likely to see a further fall in returns as a result of any Bank rate falls.

The current average rate on an easy-access savings account is 2.56%, according to Moneyfacts.